Dominion announced Friday that CEO Tom Farrell would step down in October and be replaced by Robert Blue, now executive vice president and co-chief operating officer. Farrell will continue to serve as executive chair and chairman of the board of directors, while current co-COO Diane Leopold will serve as the sole COO.

The executive shifts were announced on the same day that Dominion reported a second-quarter 2020 GAAP unaudited net loss of $1.2 billion, or $1.41 per share, compared to a gain of $54 million or 5 cents per share for the same quarter in 2019. The loss was largely driven by a $2.8 billion charge related to its cancellation of the Atlantic Coast Pipeline project earlier this month.

On a non-GAAP basis excluding those one-time charges, Dominion reported second-quarter operating earnings of $706 million, or 82 cents per share, compared to operating earnings of $619 million, or 77 cents per share, for the same quarter last year.

Farell, who turned 65 in December, said in Friday’s earnings call that Dominion’s new executive shifts are part of a long-running plan to accommodate his retirement. “As executive chair, I will continue to represent the company… [and] will continue to be focused on developing our strategic plan and Dominion’s leadership in the new clean energy economy.”

Dominion and partner Duke Energy canceled the Atlantic Coast Pipeline earlier this month, citing costs that have increased from an initial estimate of $5 billion to as much as $8 billion, as well as legal challenges from landowners and environmental groups. On the same day, Dominion announced it was selling its multistate natural-gas pipeline and storage business to Warren Buffett’s Berkshire Hathaway for about $9.7 billion.

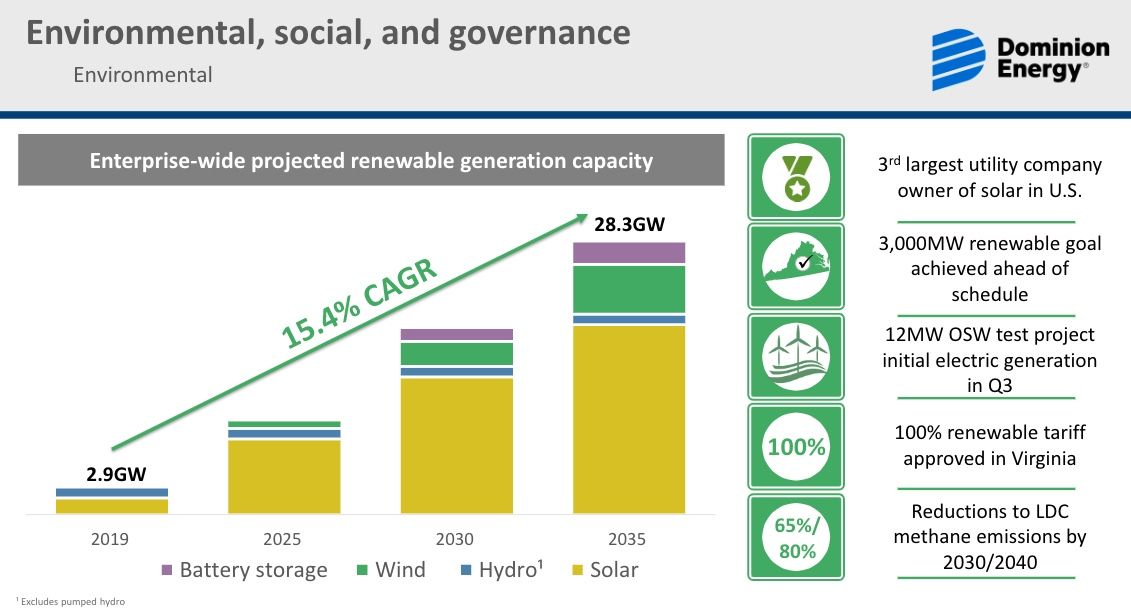

Dominion has been forced to confront a rapid shift away from carbon-emitting energy assets in its home state of Virginia under the state’s recently implemented Clean Economy Act, which calls for Dominion to achieve carbon-free energy by 2045. Its primary utility, Dominion Virginia, has asked state regulators to approve a long-range plan that would invest about $55 billion over the next 15 years to build nearly 16 gigawatts of solar, more than 5 gigawatts of offshore wind and 2.7 gigawatts of energy storage, as well as gas distribution upgrades and renewable natural gas.

This renewable energy growth plan includes a near-term solicitation for up to 1 gigawatt of onshore wind and solar and 250 megawatts of energy storage for delivery by 2023, with final power-purchase proposals due in March 2021. It also includes the country’s largest offshore wind development to date, with two 6-megawatt wind turbines recently installed as a pilot project and construction at a 2.6 gigawatt follow-up expected to begin in 2024.